As we navigate the chill of the Philadelphia winter, the current real estate market creates an opportunity for buyers and sellers. Understand the trends in current home prices, how to price strategically as a seller, where to look for great deals as a buyer, and how the current interest rates affect the market. If you're looking for guidance as you buy or sell in Philadelphia, get in touch with the MUVE | PHL team!

The Philadelphia Real Estate Market by the Numbers

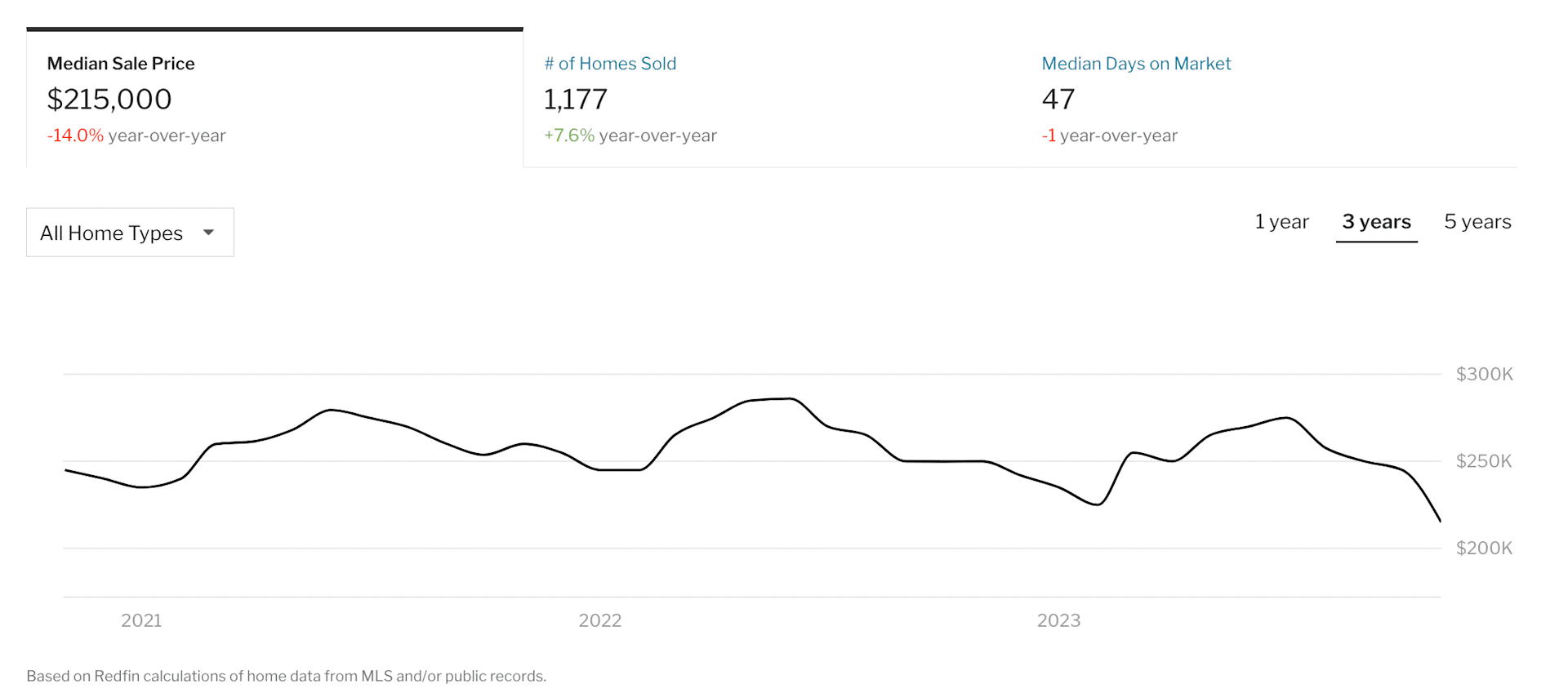

If you look at the market compared to the last few years, statistically the numbers are still lower than previous years however the market perception has become more positive as rates cuts are imminent, inflation numbers are dropping, and the general public is optimistic about the future of the economy.

Median Sale Price: $215,000 (-14% since last year)

Median Days on the Market: 47 days (-1 since last year, but down since last quarter)

Current interest rates are still increasing slowly since last quarter.

Conventional 30-Year: 7.06% (national average)

Conventional 15-Year: 6.42% (national average)

For Sellers: What to know if you’re selling a home in Philly

As a seller, being flexible to feedback and incoming offers is key.

When a property is initially listed, the positioning and pricing are decided on based upon educated predictions from current market trends. Individual buyer perception of value, however, may differ from the seller’s expectations. It is important to be receptive to feedback from incoming brokers and buyers as this market continues to settle after a tumultuous 24 months. Similarly, when receiving potential offers its important to be patient during negotiations and open to reaching a creative solution, such as minor upgrades, warranties, or inclusions as opposed to compromising on price.

An approach to making your listing stand out

Marketing and Presentation: Staging, high quality photography, and necessary updates to the home are paramount to give your home an edge against other listings in the same price range.

Social Media: In a digital age, whether we like it or not, social media is an important advertising platform. Create another lead source through consistent content, creative positioning, and buyer engagement.

Broker Events: As your listing team, it is our responsibility to host open houses, broker tours, and community events to draw eyes to your home and attract interest.

For Buyers: What to know if you’re looking to buy a home in Philly

For buyers, take action before an imminent market activity uptick

A dip in interest rates as announced by the Fed will activate a pool of buyers who have been awaiting a more cost effective climate to step off the sidelines. Once this happens, competition will increase dramatically as buying becomes more attractive to a wide variety of buyers.

Taking action now and making bold offers on fitting homes will save not only money but stress and heartache later on down the road. There is simply not enough inventory, current or coming, to match the buyer demand in the city.

Looking to buy a home in Philadelphia? Check out our top 10 questions from first-time homebuyers, answered.

Where is the housing market headed in the Spring of 2024?

This Spring, we can expect an increase in buyer activity.

As discussed above, with the improvement in interest rates and decrease in inflation numbers, the overall economic environment will become more optimistic as the year progresses. This means that we can expect to initially see a bit of a chaotic buyers market due to influx of demand. From there, potential sellers should enter the market to capture the high demand and transaction volume. This will hopefully lead to an ultimate leveling of the market in which there is a stable supply and steady demand.

Choosing the right neighborhood to buy in based on the current market in Philadelphia

Despite the slow down in the market, many popular Philadelphia neighborhoods still experiencing fast growth and investment potential. If buyers can look beyond current interest rates and make a move now to the right neighborhood, it could absolutely pay off in the long term. For the greatest growth potential, consider properties in neighborhoods like Northern Liberties, Fishtown, and Graduate Hospital. If you can buy a home slightly below market value now, in a few years when the market picks back up you can flip it for a big payoff.

Because there is more flexibility in pricing right now, it can also be a great time to buy in one of Philadelphia's most coveted neighborhoods and get a price below typical market value. Explore neighborhoods like Rittenhouse Square, Old City, and Washington Square West. Despite movements in the market, these higher end neighborhoods will always be in demand and are relatively easy to sell in any market.

How do the current interest rates affect home prices?

Elevated interest rates are on the way out.

The Fed has committed to three interest rate cuts this year, guaranteeing an improvement in market conditions and affordability. To what extent rates are lowered remains to be seen, however after 24 months of little to no decrease in rates, this is a welcome change for buyers and sellers alike.

Where is there current opportunity in the real estate market?

To buy now (or at least in the first quarter)

The current “calm before the storm” poses a strong opportunity for buyers to make lower offers in a still very buyer friendly market. There is an ability to create equity through negotiating a lower sale price or making improvements to the home as a part of negotiations.

The main pushback with purchasing immediately is the prohibitive interest rate climate. However, our stance is that the long-term upside of negotiating a lower sale price outweighs these very temporary rate costs.

Once these rate cuts do occur, this discounted price with less favorable rates can be refinanced to the current market rate.

If you're a first time home buyer or aren't sure how to best navigate the current market, consider working with a real estate agent to get your questions answered.

Do you need expert guidance as you enter the real estate market in 2024?

At MUVE | PHL, we believe education is the most valuable asset in real estate.

We provide our clients with information to help them make the best decisions, ask the right questions, and ultimately find the right homes. Let's have a conversation about what you're looking for and how we can help.